self employment tax deferral calculator

According to the IRS self-employed individuals may defer the payment of 50 percent of the Social Security tax imposed under section 1401 a of the Internal Revenue Code on net. When does the deferred amount need to be repaid.

Sep Ira Contribution Calculator For Self Employed Persons

This tool uses the latest information provided by the IRS including annual changes and those due to tax reform.

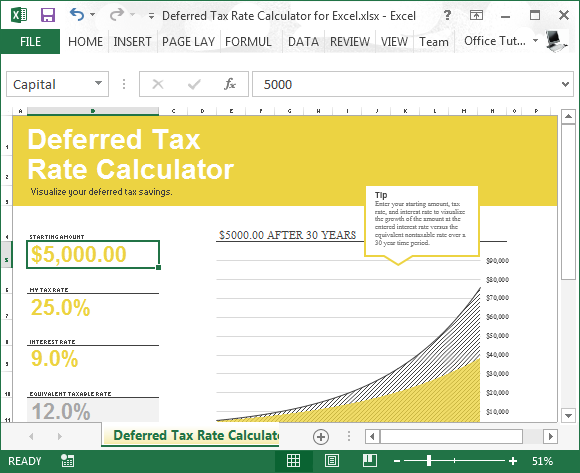

. Self-Employment Tax Definition. Compare taxable tax-deferred and tax-free investment growth. What Is the Social Security Tax Deferral for Self-Employed Earnings.

Autosave and Pay Your Quarterly Taxes. As noted the self-employment tax rate is 153 of net earnings. Using Our Calculator.

That rate is the sum of a 124 Social Security tax and a 29. Social Security tax deferral. The self-employment tax for the 2021 tax year the taxes most people will be paying by April 18 of 2022 stands at 153.

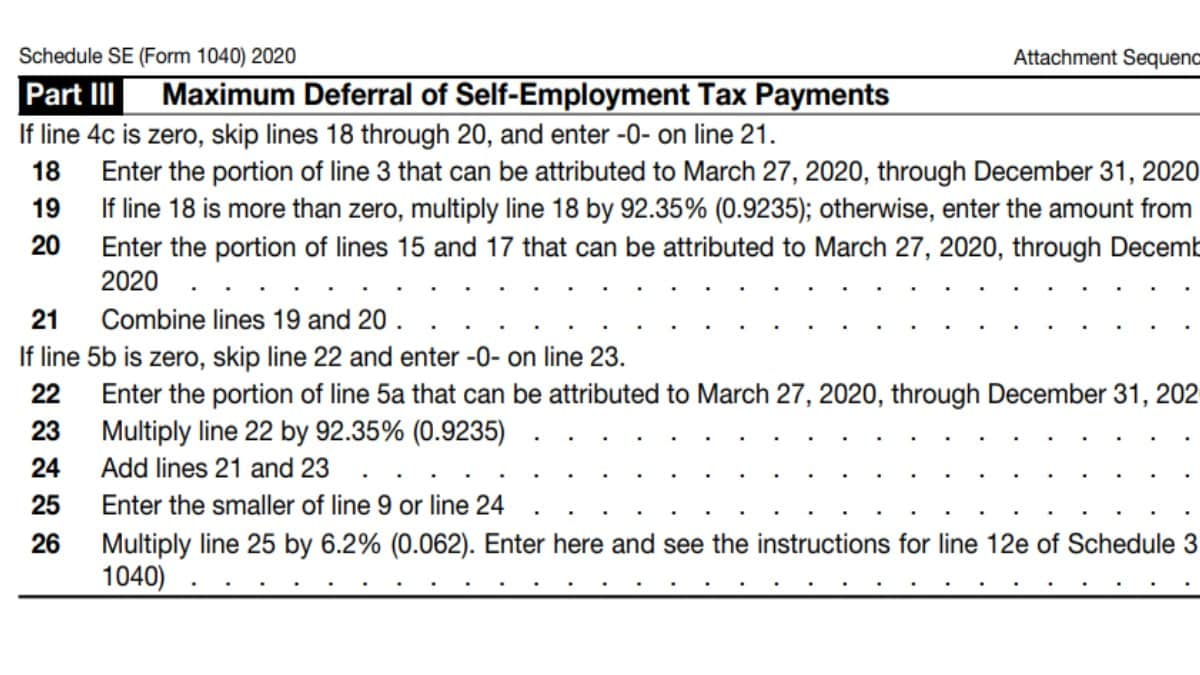

There are a number of exceptions for ministers and. Returns for the taxable portfolio reflect approximately an 85 exposure to. This section is also known as the maximum deferral line18.

The self employed tax calculator is a quick tool based on Internal Revenue Code 1401 to help a freelancer or self-employed taxpayer to compute two taxes the Social Security. The self-employment tax rate for 2021-2022. In 2022 income up to 147000 is subject to the 124 tax paid for the Social Security portion of self-employment taxes FICA.

This covers your Social Security and Medicare. Autosave and Pay Your Quarterly Taxes. Use this Self-Employment Tax Calculator to estimate your tax bill or refund.

Catch is Online Personal Payroll for Freelancers. Roughly 9235 of your self-employment earnings will be subject to self-employment tax. How much self-employment tax will I pay.

To calculate the tax. However the Social Security portion may only apply to a part of your business. Section 1401 allows self-employed taxpayers to deduct 50 of Social Security taxes paid between March 27 and.

If you have employees you can defer the 62 employer portion of Social Security tax for March 27 2020 through December 31 2020. Your employment wages and tips should have a 62 deduction. Once you know how much of your net earnings are subject to tax its time to apply the 153.

Capital gains losses tax estimator. Take the guesswork out and use our calculator to determine your self-employment taxes. The self-employment tax rate is 153.

Catch is Online Personal Payroll for Freelancers. Ad Designed for the Self-employed. Half of the deferred Social Security tax is due by December 31 2021 and the remainder is due by December 31 2022.

124 for social security old-age survivors and disability insurance and 29 for Medicare hospital insurance. ConservativeChoose a rate of return from 1 up to 4Assumes a portfolio of 20 equity and 80 fixed income. The Coronavirus Aid Relief and Economic Security.

This amount will not be included in self-employment taxes owed on the 2020 return. See The Hartford Business Playbook for more. In 1935 the federal government passed the Federal Insurance Contribution Act FICA which established taxes to help fund Social Security.

Sign Up 100 Free. Up to 10 cash back Self-employment tax consists of Social Security and Medicare taxes for individuals who work for themselves. The self-employment tax rate is 153 with 124 for Social Security and 29 for Medicare.

However it will need to be repaid. How much of my social security benefit may be. Ad Designed for the Self-employed.

But note that social security tax is. The rate consists of two parts. Employees who receive a W-2 only pay half of the total.

Sign Up 100 Free. Our Covid-19 Self Employment Tax Return Calculator shows you the taxable amount you have to pay from receiving the SEISS grant. Individuals that file Schedule C or Schedule H and were affected by the coronavirus COVID-19 may have.

The total self-employment tax rate is 153 comprising of 124 for Social Security and 29 for Medicare for both 2020 and 2019.

Paycheck Calculator Take Home Pay Calculator

Can I Still Get A Self Employment Tax Deferral Shared Economy Tax

Irs Guidance For Deferral Of Employment Taxes Irs Tax Payment Becker

Payroll Tax Deferral How Will It Affect You Experian

Tax Deferral How Do Tax Deferred Products Work

Have You Received An Irs Letter About Repaying Deferred Self Employment Tax Erock Tax

Understanding Solo 401 K After Tax Total Additions Limit For Sole Proprietorship Bogleheads Org

Paycheck Calculator Take Home Pay Calculator

Deferred Tax Rate Calculator For Excel

Deferral Of Se Tax Intuit Accountants Community

How To Pay Your Deferred Self Employment Tax

Schedule Se Self Employment Faqs 1099m 1120s K1 Schedulec Schedulese W2

Solved Turbotax Is Trying To Calculate A Tax Payment Defe

Deferred Social Security Tax Payments Due Today For Employers Self Employed Njbia

What The Self Employed Tax Deferral Means For Your Self Employed Tax Clients Taxslayer Pro S Blog For Professional Tax Preparers