how much federal taxes deducted from paycheck nc

After a few seconds you will be provided with a full. North Carolina has a flat income tax rate of 525 meaning all taxpayers pay this rate regardless of their taxable income or filing status.

Government Revenue Taxes Are The Price We Pay For Government

This can make filing state taxes in the state relatively.

. Deductions for the employers benefit are limited as follows. New Federal Tax Withholding Tables were added to the Integrated HR-Payroll System last month and many of you are wondering if you need to change your withholding allowance. North Carolinas flat tax rate for 2018 is 549 percent and standard deductions were 8750 if you filed as single and 17500 if you were married and filing jointly.

The income tax is a flat rate of 525. Ad Estimate Your Taxes and Refunds Easily With This Free Tax Calculator from AARP. Federal income tax and fica tax withholding are mandatory so theres no way around them unless your earnings are very low.

If the taxpayer is not filing a federal income tax return the taxpayer must. Money may also be deducted or subtracted from a paycheck to pay for retirement or health benefits. Median household income in 2020 was 67340.

No state-level payroll tax. There is a flat income tax rate of 525 which means no matter who you are or how much you make this is the rate that will be deducted. For federal income tax purposes the contribution limitation for cash contributions for tax year 2021 is 100 of an individuals adjusted gross income AGI.

Federal Insurance Contributions Act tax FICA 2022. Simply enter their federal and state W-4 information as well as their pay rate deductions and benefits and well crunch the numbers for you. For North Carolina income tax.

Federal Paycheck Quick Facts. Plus to make things even breezier. North Carolina tax year starts from July 01 the year before to June.

FICA taxes consist of Social Security and Medicare taxes. FICA taxes are commonly called the payroll tax. Federal Income Tax Total from all Rates.

Enter Your Status Income Deductions and Credits and Estimate Your Total Taxes. There is a flat income tax rate of 499 which means no matter who you are or how much you make this is the rate that will be deducted. The state of north carolina has an income tax.

To use our North Carolina Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button. Federal income tax total from all rates. Plus to make things even breezier.

Ad File 1040ez Free today for a faster refund. Employer can withhold the. How much federal taxes deducted from paycheck nc.

Federal income tax rates range from 10 up to a top marginal rate of 37. However they dont include all taxes related to payroll. Therefore a taxpayer must determine federal adjusted gross income before beginning the North Carolina return.

They can also help calculate the amount of overtime pay will be paid out directly in your check. A in non-overtime workweeks wages may be reduced to the minimum wage level but cannot go below the minimum wage. The information provided by the Paycheck.

Total Federal Income Tax Due. The amount of money you. Payroll taxes and income tax.

:max_bytes(150000):strip_icc()/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow

An Updated Analysis Of A Potential Payroll Tax Holiday Itep

Payroll Tax What It Is How To Calculate It Bench Accounting

How Much Does A Small Business Pay In Taxes

What Are The Major Federal Payroll Taxes And How Much Money Do They Raise Tax Policy Center

State Income Tax Rates And Brackets 2022 Tax Foundation

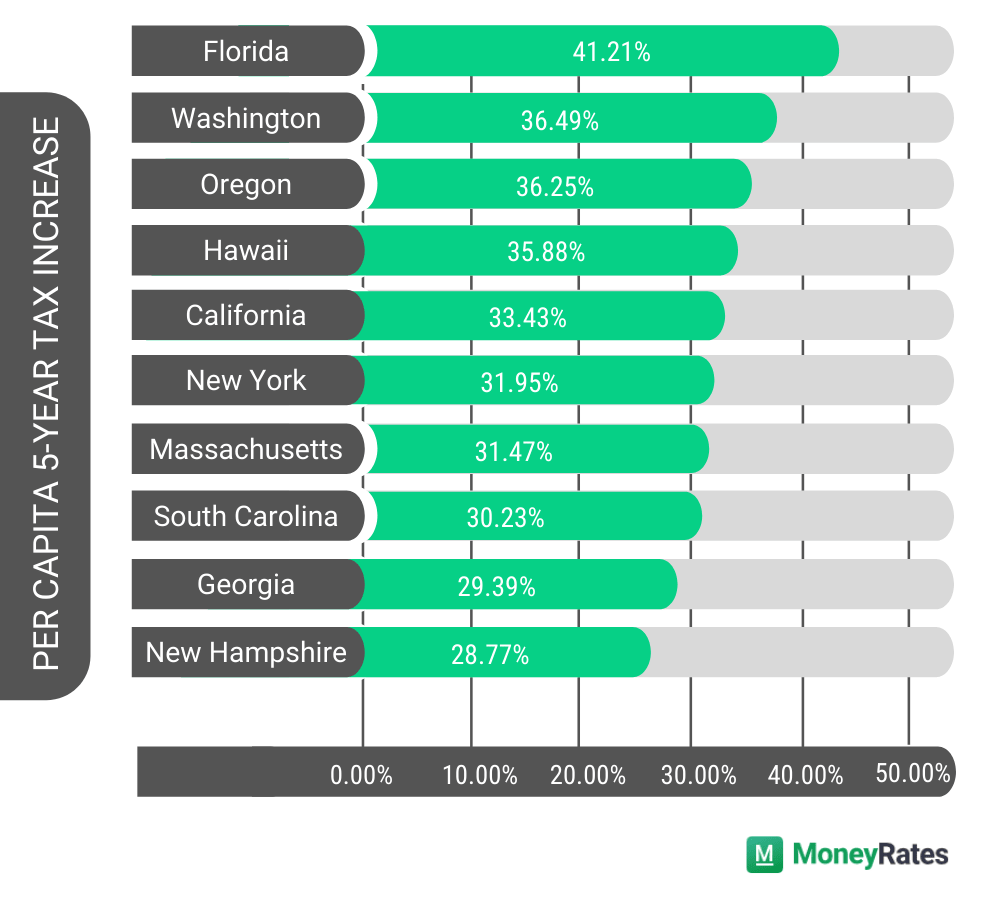

Which States Pay The Most Federal Taxes Moneyrates

Tax Withholding For Pensions And Social Security Sensible Money

Paycheck Calculator Take Home Pay Calculator

What Are The Major Federal Payroll Taxes And How Much Money Do They Raise Tax Policy Center

Irs Announced Federal Tax Filing And Payment Deadline Extension The Turbotax Blog

Federal Tax Cuts In The Bush Obama And Trump Years Itep

How Much Federal Tax Is Withheld From A 300 Weekly Check From A Single Person With No Dependents Quora

Calculating State Taxes And Take Home Pay Video Khan Academy

Trump S Proposed Payroll Tax Elimination Itep

Is There A Wage Minimum Limit Before Federal Tax Is Withheld My W 2 Shows No Federal Tax Withheld On My Line 1 Wages Of 4657 89

What Are The Major Federal Payroll Taxes And How Much Money Do They Raise Tax Policy Center

Policy Basics Federal Payroll Taxes Center On Budget And Policy Priorities

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)